Unlocking Business Potential:

A Comprehensive Guide to Equipment Financing

For many small and mid-sized businesses, obtaining the essential equipment needed for operations can pose a considerable financial challenge. Enter equipment financing, a specialized financial solution designed to bridge the gap between ambition and reality. In this comprehensive exploration of equipment financing, we delve into the intricacies of this financing avenue, dissecting its key attributes, benefits, and its pivotal role in enabling businesses to thrive.

Demystifying Equipment Financing

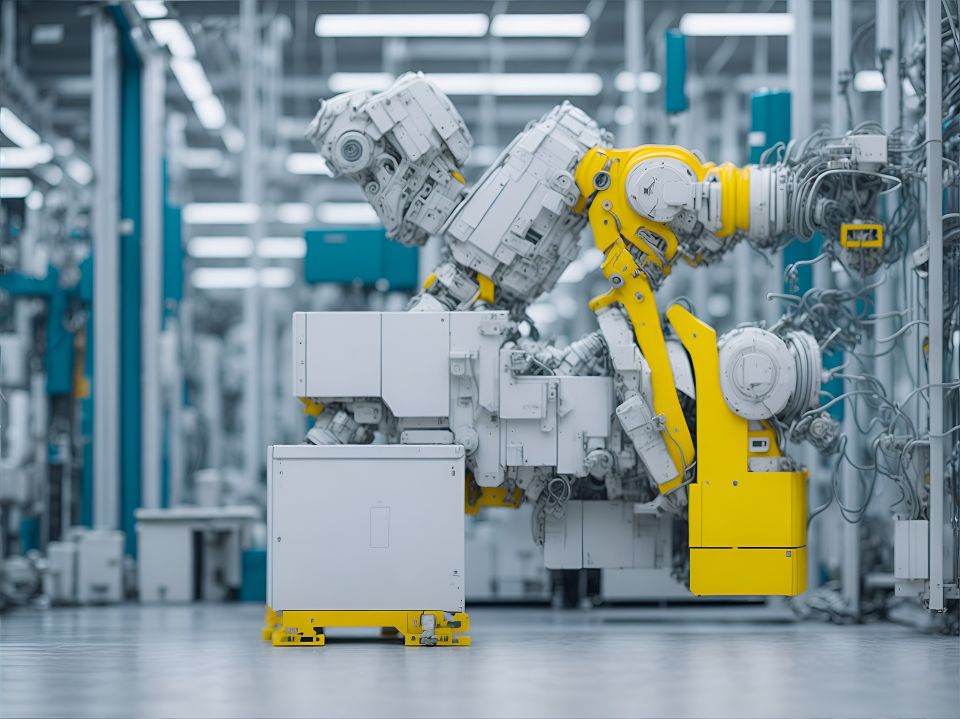

Equipment financing is a tailored financial product that allows businesses to acquire necessary equipment without the burdensome upfront costs. It's a flexible solution that provides businesses with the means to access, upgrade, or replace equipment crucial for their operations. This financing option extends to a broad spectrum of industries, from manufacturing and construction to healthcare and technology.

Key Features of Equipment Financing Diverse Equipment Coverage:

Equipment financing encompasses a wide range of assets, including machinery, vehicles, technology, medical equipment, and more. This versatility ensures that businesses across various sectors can find financing solutions tailored to their specific needs.

Minimal Initial Costs:

Equipment financing typically requires minimal to no down payment, reducing the immediate financial strain on businesses. This makes it an attractive option for conserving capital.

Tax Benefits:

Businesses often enjoy tax advantages through equipment financing, as they can typically deduct interest and depreciation expenses from their taxable income.

Preservation of Working Capital:

By opting for equipment financing, businesses can preserve their working capital for other crucial expenditures, such as payroll, inventory, and marketing.

Fixed Interest Rates:

Many equipment financing arrangements offer fixed interest rates, providing businesses with predictable monthly payments throughout the term of the loan or lease.

The Vital Role of Equipment Financing in Business Growth

Equipment financing plays a pivotal role in driving business growth and success in several ways:

Modernization and Efficiency:

Access to the latest equipment and technology enhances operational efficiency, productivity, and competitiveness.

Conservation of Capital:

Businesses can maintain liquidity and allocate capital strategically for expansion, marketing, and unforeseen expenses, safeguarding their financial stability.

Tax Efficiency:

Tax benefits, including potential deductions, can significantly reduce the overall cost of acquiring equipment.

Flexibility:

Equipment financing offers various structures, such as loans and leases, allowing businesses to choose the option that best aligns with their financial goals and cash flow.

Maintaining Competitiveness:

Staying ahead of competitors often hinges on having cutting-edge equipment, and financing ensures businesses can keep pace with industry advancements.

Navigating the Equipment Financing Process

Securing equipment financing involves a structured approach:

Identify Equipment Needs:

Clearly define the type and specifications of the equipment required to enhance your operations.

Choose a Lending Partner:

Select a reputable lender with experience in equipment financing, ensuring they understand your industry and financing requirements.

Application and Evaluation:

Complete the lender's application process, which typically involves providing financial documents and details about the equipment. The lender assesses your creditworthiness and evaluates the equipment's value.

Approval and Terms:

Once approved, review and agree to the financing terms, which include interest rates, monthly payments, and the length of the financing arrangement.

Equipment Acquisition:

Funds are disbursed, enabling you to acquire the equipment promptly. Ensure proper installation and training if necessary.

Repayment: Adhere to the agreed-upon repayment schedule, making monthly payments promptly to fulfill the financing arrangement.

Prudent Management and Repayment

Vigilant management of equipment financing is essential. Timely repayments are crucial to maintaining a positive credit history and a healthy financial relationship with the lender. It's advisable to monitor equipment usage, maintenance, and depreciation to maximize the equipment's lifespan and overall value.

Keep in mind, equipment financing is a strategic tool that empowers businesses to overcome financial barriers and access the equipment needed to thrive and compete in today's dynamic marketplace.

By understanding its features, benefits, and the financing process, businesses can leverage equipment financing to achieve operational excellence, boost productivity, and drive long-term success.

Equipment financing is not merely a financial transaction; it's a catalyst for business growth and prosperity.

Demystifying Equipment Financing

Equipment financing is a tailored financial product that allows businesses to acquire necessary equipment without the burdensome upfront costs. It's a flexible solution that provides businesses with the means to access, upgrade, or replace equipment crucial for their operations. This financing option extends to a broad spectrum of industries, from manufacturing and construction to healthcare and technology.

Key Features of Equipment Financing Diverse Equipment Coverage:

Equipment financing encompasses a wide range of assets, including machinery, vehicles, technology, medical equipment, and more. This versatility ensures that businesses across various sectors can find financing solutions tailored to their specific needs.

Minimal Initial Costs:

Equipment financing typically requires minimal to no down payment, reducing the immediate financial strain on businesses. This makes it an attractive option for conserving capital.

Tax Benefits:

Businesses often enjoy tax advantages through equipment financing, as they can typically deduct interest and depreciation expenses from their taxable income.

Preservation of Working Capital:

By opting for equipment financing, businesses can preserve their working capital for other crucial expenditures, such as payroll, inventory, and marketing.

Fixed Interest Rates:

Many equipment financing arrangements offer fixed interest rates, providing businesses with predictable monthly payments throughout the term of the loan or lease.

The Vital Role of Equipment Financing in Business Growth

Equipment financing plays a pivotal role in driving business growth and success in several ways:

Modernization and Efficiency:

Access to the latest equipment and technology enhances operational efficiency, productivity, and competitiveness.

Conservation of Capital:

Businesses can maintain liquidity and allocate capital strategically for expansion, marketing, and unforeseen expenses, safeguarding their financial stability.

Tax Efficiency:

Tax benefits, including potential deductions, can significantly reduce the overall cost of acquiring equipment.

Flexibility:

Equipment financing offers various structures, such as loans and leases, allowing businesses to choose the option that best aligns with their financial goals and cash flow.

Maintaining Competitiveness:

Staying ahead of competitors often hinges on having cutting-edge equipment, and financing ensures businesses can keep pace with industry advancements.

Navigating the Equipment Financing Process

Securing equipment financing involves a structured approach:

Identify Equipment Needs:

Clearly define the type and specifications of the equipment required to enhance your operations.

Choose a Lending Partner:

Select a reputable lender with experience in equipment financing, ensuring they understand your industry and financing requirements.

Application and Evaluation:

Complete the lender's application process, which typically involves providing financial documents and details about the equipment. The lender assesses your creditworthiness and evaluates the equipment's value.

Approval and Terms:

Once approved, review and agree to the financing terms, which include interest rates, monthly payments, and the length of the financing arrangement.

Equipment Acquisition:

Funds are disbursed, enabling you to acquire the equipment promptly. Ensure proper installation and training if necessary.

Repayment: Adhere to the agreed-upon repayment schedule, making monthly payments promptly to fulfill the financing arrangement.

Prudent Management and Repayment

Vigilant management of equipment financing is essential. Timely repayments are crucial to maintaining a positive credit history and a healthy financial relationship with the lender. It's advisable to monitor equipment usage, maintenance, and depreciation to maximize the equipment's lifespan and overall value.

Keep in mind, equipment financing is a strategic tool that empowers businesses to overcome financial barriers and access the equipment needed to thrive and compete in today's dynamic marketplace.

By understanding its features, benefits, and the financing process, businesses can leverage equipment financing to achieve operational excellence, boost productivity, and drive long-term success.

Equipment financing is not merely a financial transaction; it's a catalyst for business growth and prosperity.